USCF – Aim for Growth with Steady Income

US Consumer Credit Fund

MarkitLend US Consumer Credit Fund selects loans from America’s leading consumer loan origination platforms. We use proprietary software and analytical tools to select loans that offer high risk adjusted returns. The portfolio is managed by Fernando Sanchez, who developed the credit analytics and has a proven track record of success. Start your investment today.

Key Fund Features

- Nearly 1,300 loans in the portfolio

- Stated loan purpose is debt consolidation or credit card refinance

- Wide range of credit qualities

- Initial maturities of 1 to 5 years

- Overall maturity 2.75 years

- Active loan loss provisioning

- Limited partnership, IRA eligible

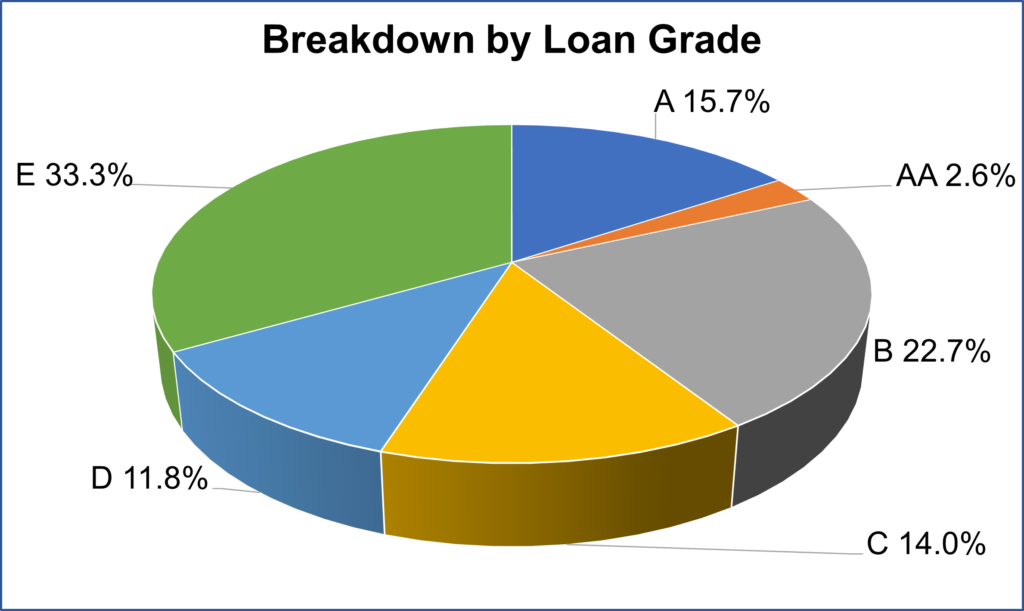

Mix of Credit Qualities

Originators indicate credit quality according to their scoring system. We overlay on top of that our own credit scoring system. This approach helps us identify relative value. Our goal is to select loans that offer a compelling reward-risk tradeoff.

We also take into account our view of economic conditions and loan loss rates. For a relatively defensive position we focus our investments around relative lower risk loans. If we want to take a relatively bullish position, we can select loans offering higher yields that we believe are likely to outperform.

Note: The chart above is illustrative and might not necessarily reflect our current allocation. See our fund upates for current information.

Successful investing starts with a disciplined investment process. Click here to learn more about our process.

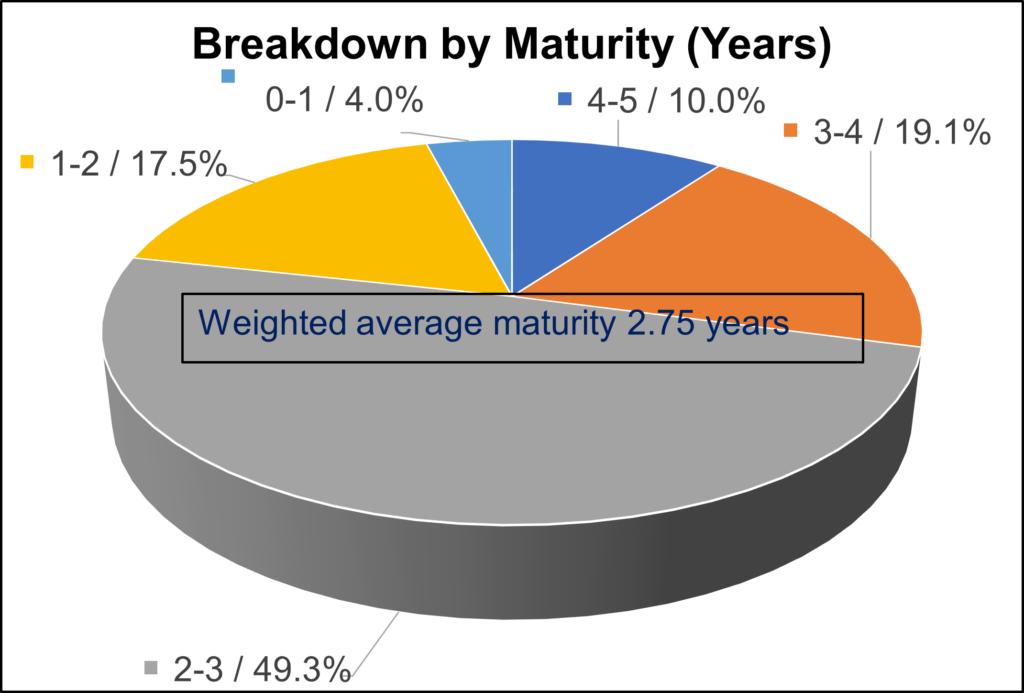

Loan Maturities

Loans are issued with maturities of 1 to 5 years. They pay principal and interest monthly. This assures us a continual stream of cash flow to provide investors liquidity reinvest for compound growth. The portolfio dollar weighted average maturity is about 2.75 years.

Note: The chart above is illustrative and might not necessarily reflect our current allocation. See our fund upates for current information.

The Fund is IRA eligible. Find out how to invest your IRA.

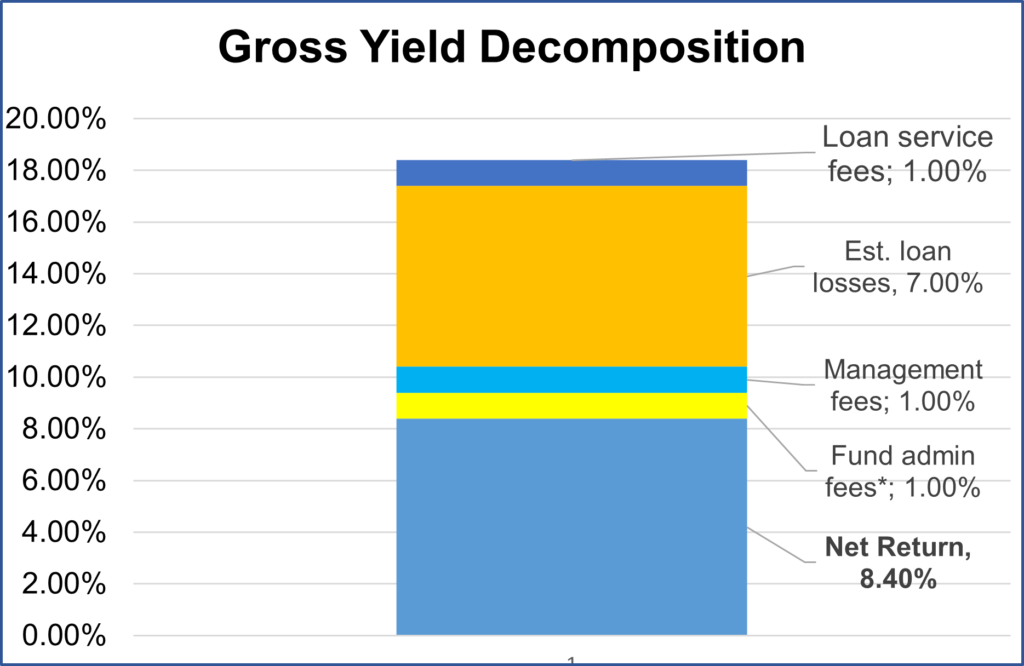

From Gross Yield to Net Return

We make provisions to take into account potential loan defaults. Interest is accounted for when actually receieved. Loans that go into default are written off against the loan loss provision first. If provisions are not sufficient the fund records the actual loss. The result is that the NAV reflects the actual return invetors are earning. MarkitLend has a decade of experience with this asset class. Our provisioning rates have historically been accurate. In short, there have been no surprises.

The loans we purchase have gross yield of between 8% and 25%. Each month loans pay principal and interest. From the monthly loan payments the loan servicer takes a fee of approximately 1%. We account for loan loss provisions. Currently we are provisioning 7%. We deduct up to 2% for management fees and fund expenses. The result translates into our daily calculated Fund NAV.

Note: The chart above is illustrative and might not necessarily reflect our current allocation. See our fund upates for current information.

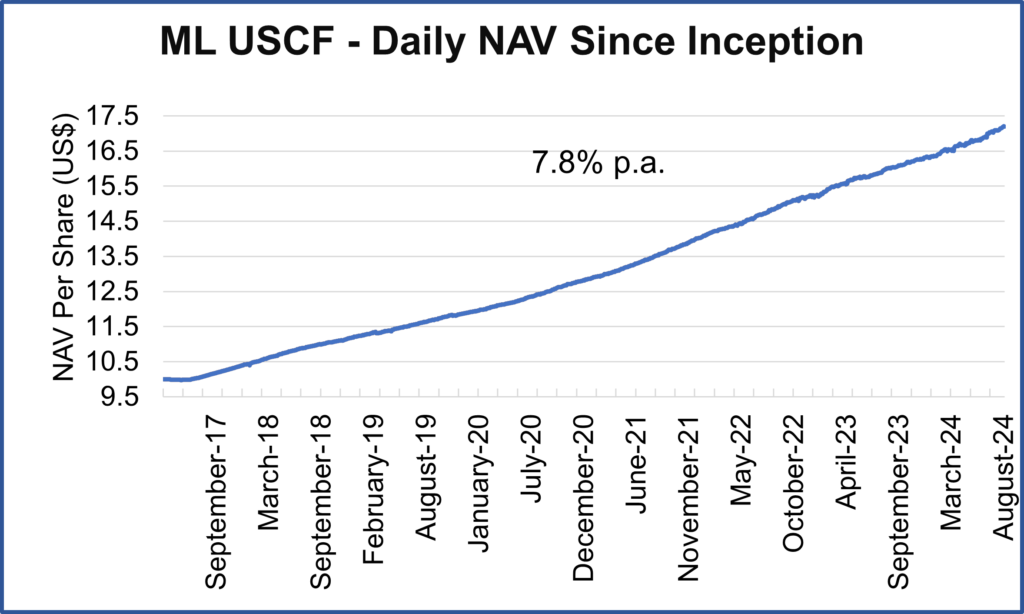

Our Nice Long Steady Ride Up

Markitlend have been investing in consumer loans for over a decade. Our principals have careers spanning more than 30 years. We understand the volatility that investors can experience in equity and bond markets. When investors can count on steady returns, they can be can be confident their savings wll be intact. The math of compounding is simple. An investment growing at 7.1% per annum will double every 10 years.

Note: Past performance does not guarantee future performance. Returns may vary over time. MarkitLend does not guarantee investment peformance. An investment in consumer loans carries with it the risk of loss or all or part of your investment. Investors should consult a qualified investment professional when making an investment decision. See our our fund materials for further disclosure.